Related Works

Bitcoin

In 2004, Satoshi Nakamoto carved scarcity out of the stone of abundance. Despite its enablement of infinite replicability, the internet could now have its own native currency on the blockchain: Bitcoin - the first truly digital solution to the problem of money [Nak]. Bitcoin introduced PoW mining to the world, allowing anyone with compute power to participate in securing the network. Leveraging Nakamoto consensus, Bitcoin has become the most decentralized blockchain, but with only 7 TPS, it lacks the scalability [Aut] necessary to transition beyond “Store of Value” use cases. BTC’s role as “digital gold” is unquestioned, but as the hype around the Lightning Network illustrates, many in the Bitcoin community want more.

Ethereum

The most popular dapp platform and the first Turing-complete blockchain [Buta]. The abstractions offered by the Ethereum Virtual Machine (EVM) and the popular Solidity programming language allowed hundreds of thousands, if not millions, of developers to build decentralized applications for the first time [She], which has given rise to DeFi, Play2Earn, NFTs, etc. Ethereum offered a higher TPS than Bitcoin at the expense of some decentralization, but even with its 15 TPS, major scalability bottlenecks remain [Fri].

Ethereum 2

The catchall term for the community driven upgrades to Ethereum meant to resolve the scalability, security, efficiency, etc. challenges. Two of the major changes are the move from PoW to PoS and the introduction of sharding. Sharding purportedly will offer up to 100k TPS [RK], but the migration to PoS draws concerns regarding decentralization [You]. Already, we are witnessing significant concentration among major CeFi custodians such as Binance, Kraken, etc and staking pools like Lido.

Solana

A high TPS chain, 50k TPS, that leverages both Proof of History (PoH) and sharding [Yak]. Solana has very short block times, 400ms [Tead], which allows applications built on top of the network to feel like Web 2 in terms of performance. In order to achieve this level of performance, the requirements to run a validator far exceed most other networks [Teae], thereby pricing out many players. Another tradeoff exists between performance and network availability, which has been visible more recently with a few notable chain restarts [McS] [Mil]. Solana also has one of the most active developer communities, but the transition to Rust from Solidity has proved challenging for many.

Polygon

An L2 scaling solution built on top of Ethereum meant to solve many of the scalability challenges on the main chain by leveraging PoS and side chains [Teac]. Polygon has attracted a sizable number of developers given its EVM compatibility, which allows dapp developers to port over their code with minimal to no changes [Teab]. Polygon faces criticisms regarding the lack of decentralization and stability of its validator set, which has thus far remained unchanged since testnet, although they are actively working on improving these dynamics with Polygon DAO [Rze].

Binance Smart Chain

A hard fork of the Go Ethereum (Geth) codebase. One of the major differentiators between BSC and Ethereum is BSC’s Proof of Staked Authority (PoSA), a consensus mechanism that combines Proof of Authority (PoA) and Delegated Proof of Stake (DPoS) [Teaa]. By leveraging this new consensus mechanism, BSC achieved faster transaction times, higher TPS, and lower fees [CZ]. Since its inception, BSC has faced criticism regarding insufficient decentralization given that its validator set is more or less fixed given the 3rd parties’ relationship with Binance and the high stake requirements (minimum $2.3m USD or 10,000 BNB vs Ethereum 2 $32k USD or 32 ETH as of July 2022) combined with the fact that only 2 of the 21 are involved in consensus activities at a given time [Tra]. The claim that Binance itself runs any of the nodes can be disproven via onchain data [BsC].

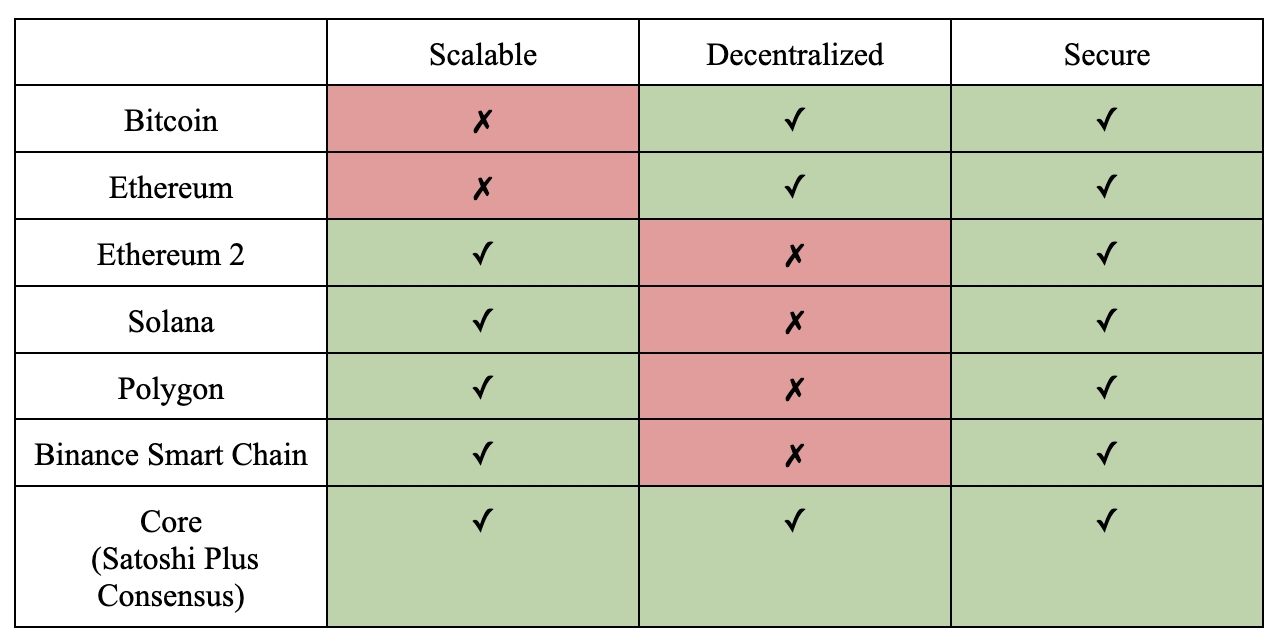

Comparisons

YESCOIN is an evolution of the Geth codebase. We leveraged the improvements made by the BSC team to add greater throughput and cheaper transactions by way of hard fork. Nevertheless, we differ from BSC in many ways. One preeminent difference is that YESCOIN is based on Satoshi Plus Consensus, which relies on Proof of Work (PoW) alongside Delegated Proof of Stake (DPoS). With these modifications, we’re able to remain decentralized without the performance tradeoffs seen in traditional PoW consensus systems. Additionally, with our hybrid YESCOIN based off of both delegated Bitcoin hash power and delegated stake, we’ve created a fluid market for validators and rewards that anyone can participate in.

Last updated